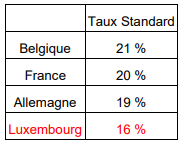

As of January 1, 2023, the Luxembourg VAT has been reduced from 17% to 16%. This move by the Luxembourg government is a direct response to counter the effects of inflation as well as the energy crisis. If the 1% reduction is applied to all products and goods purchased in the Grand Duchy, real estate is one of the major beneficiaries.

A courageous tax measure that has received the support of the social partners

"I am delighted that this text has been adopted unanimously by the Chamber of Deputies in record time. It will considerably curb inflation and support households and businesses in the Grand Duchy," says Finance Minister Yuriko Backes (DP).

VAT is the second largest source of revenue in the country, and by lowering the rate in this way, the government is showing that it is willing to make some concessions to help the future owners.

In 2023 only

For the time being, the government measure has been agreed for the year 2023 only. No one can predict if it will be extended. When buying your new apartment in our project Brooklyn at Bonnevoie, for example, you immediately benefit from this reduced rate for all instalments paid in 2023. The savings are substantial and worth taking advantage of.

One more argument to invest in real estate in Luxembourg

This represents a substantial difference on a real estate purchase of 500.000€.

Buy now your new apartment in Brooklyn (Bonnevoie)

At Eaglestone, we are convinced that we must take advantage of this VAT reduction to invest today in the city we want to live in tomorrow.

Our Brooklyn project, behind the station area and at the edge of Bonnevoie, the fact that we are certain of the high potential of this location is proof of this. We are building a new district where it is good to live less than fifteen minutes from all the facilities of the city and the business districts.

And as good news never comes alone, there is no indexation clause on the amount of your future apartment at Brooklyn.